SCHEDULE 14A

(Rule 14a-101)

INFORMATION REQUIRED IN PROXY STATEMENT

SCHEDULE 14A INFORMATION

Proxy Statement Pursuant to Section 14(a) of the Securities

Securities Exchange Act of 1934

Filed by the Registrant x Filed by a partyParty other than the Registrant ¨

Check the appropriate box:

| ¨ | Preliminary Proxy Statement | |

| ¨ | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) | |

| x | Definitive Proxy Statement | |

| ¨ | Definitive Additional Materials | |

| ¨ | Soliciting Material Pursuant to § 240.14a-12 | |

PRGX GLOBAL, INC.

(Name of Registrant as Specified In Its Charter)

(Name of Person(s) Filing Proxy Statement, if Other Than Theother than the Registrant)

Payment of Filing Fee (Check the appropriate box):

| x | No fee required. | |||

| ¨ | Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11. | |||

| (1) | Title of each class of securities to which transaction applies:

| |||

| (2) | Aggregate number of securities to which transaction applies:

| |||

| (3) | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined):

| |||

| (4) | Proposed maximum aggregate value of transaction:

| |||

| (5) | Total fee paid:

| |||

| ¨ | Fee paid previously with preliminary materials: | |||

| ¨ | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. | |||

| (1) | Amount Previously Paid:

| |||

| (2) | Form, Schedule or Registration Statement No.:

| |||

| (3) | Filing Party:

| |||

| (4) | Date Filed:

| |||

PRGX GLOBAL, INC.

600 GALLERIA PARKWAY

SUITE 100

ATLANTA, GEORGIA 30339

(770) 779-3900

NOTICE OF ANNUAL MEETING OF SHAREHOLDERS

TO BE HELD TUESDAY, JUNE 24, 201416, 2015

TO THE SHAREHOLDERS OF

PRGX GLOBAL, INC.:

NOTICE IS HEREBY GIVEN that the Annual Meeting of Shareholders of PRGX GLOBAL, INC. (the “Company”) will be held at the Company’s offices, 600 Galleria Parkway, Atlanta, Georgia 30339, on Tuesday, June 24, 2014,16, 2015, at 9:00 a.m., for the following purposes:

| 1. | To elect two Class |

| 2. | To ratify BDO USA, LLP as our independent registered public accounting firm for the fiscal year |

| 3. | To approve the Company’s executive compensation (the “Say-on-Pay Resolution”); |

| 4. |

| To transact such other business as may properly come before the meeting or any adjournments thereof. |

The proxy statement is attached. Only record holders of the Company’s common stock at the close of business on April 21, 201415, 2015 will be eligible to vote at the meeting.

If you are not able to attend the meeting in person, please complete, sign, date and return your completed proxy in the enclosed envelope. If you attend the meeting, you may revoke your proxy and vote in person. However, if you are not the registered holder of your shares you will need to get a proxy from the registered holder (for example, your broker or bank) in order to attend and vote at the meeting.

| By | Order of the Board of Directors, | |

| ||

| Patrick G. Dills, Chairman |

April 30, 2014May 6, 2015

A copy of the Company’s Annual Report on Form 10-K for the year ended December 31, 20132014 is enclosed with this notice and proxy statement.

PRGX GLOBAL, INC.

600 GALLERIA PARKWAY

SUITE 100

ATLANTA, GEORGIA 30339

(770) 779-3900

PROXY STATEMENT

FOR ANNUAL MEETING OF SHAREHOLDERS

June 24, 201416, 2015

GENERAL INFORMATION

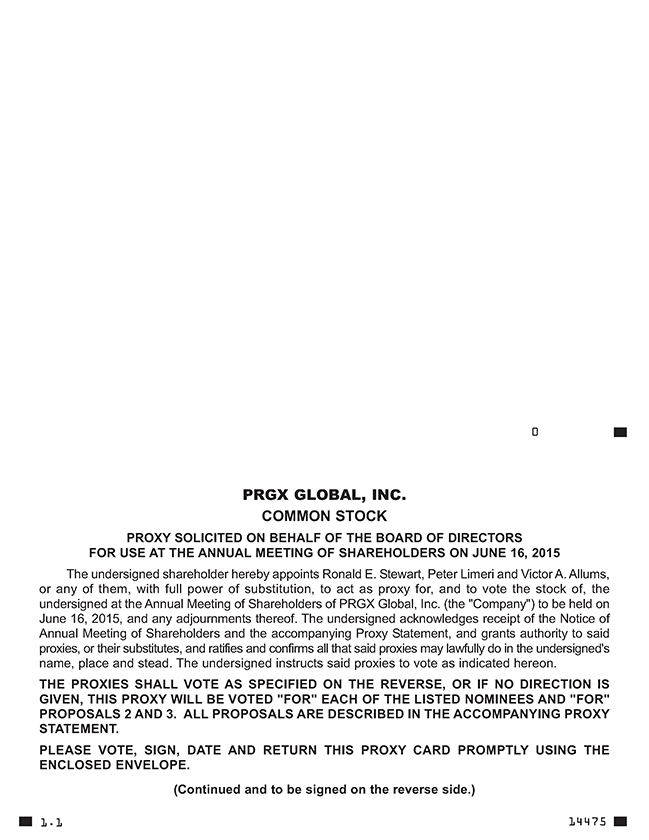

The Board of Directors of PRGX Global, Inc. (which we refer to in this proxy statement as “PRGX”, the “Company”, “we”, “us” or “our”) is furnishing you this proxy statement to solicit proxies on its behalf to be voted at the 20142015 Annual Meeting of Shareholders. The annual meeting will be held on Tuesday, June 24, 2014,16, 2015, at 9:00 a.m., at the Company’s offices, 600 Galleria Parkway, Atlanta, Georgia 30339. The proxies may also be voted at any adjournments or postponements of the meeting. Upon a vote of the shareholders present at the annual meeting, we may adjourn the meeting to a later date if there are not sufficient shares present in person or by proxy to constitute a quorum or to permit additional time to solicit votes on any proposal to be presented at the annual meeting. You may obtain directions to the location of the 20142015 Annual Meeting by contacting Victor A. Allums, Senior Vice President, General Counsel and Secretary, at the address or telephone number listed above.

This proxy statement and the accompanying form of proxy are first being mailed to shareholders on or about April 30, 2014.May 6, 2015. You must complete and return the proxy for your shares of common stock to be voted.

Any shareholder who has given a proxy may revoke it at any time before it is exercised at the meeting by:

Shareholders who hold shares in “street name” (e.g., in a bank or brokerage account) must obtain a legal proxy form from their bank or broker to vote at the meeting. You will need to bring the legal proxy with you to the meeting, or you will not be able to vote at the meeting.

1

All communications to the Secretary should be addressed to the Secretary at the Company’s offices, 600 Galleria Parkway, Suite 100, Atlanta, Georgia 30339. Any proxy which is not revoked will be voted at the annual meeting in accordance with the shareholder’s instructions. If a shareholder returns a properly signed and dated proxy card but does not mark any choices on one or more items, his or her shares will be voted in accordance with the recommendations of the Board of Directors as to such items. The proxy card gives authority to the proxy holders to vote shares in their discretion on any other matter properly presented at the annual meeting.

The Company will pay all expenses in connection with the solicitation of proxies, including postage, printing and handling and the expenses incurred by brokers, custodians, nominees and fiduciaries in forwarding proxy material to beneficial owners. In addition to solicitation by mail, solicitation of proxies may be made personally or by telephone, facsimile or other means by directors, officers and employees of the Company and its subsidiaries. Directors, officers and employees of the Company will receive no additional compensation for any such further solicitation. The Company has retained Innisfree M&A Incorporated to assist in the solicitation. The fee to be paid for such services is estimated at approximately $12,500, plus reasonable out-of-pocket expenses.

Voting Requirements

Only holders of record of the Company’s common stock at the close of business on April 21, 201415, 2015 (the “Record Date”) are entitled to notice of, and to vote at, the annual meeting. Holders on the Record Date are referred to as the “Record Holders” in this proxy statement. On the Record Date, the Company had outstanding a total of 30,071,46225,654,992 shares of common stock. Each share of common stock is entitled to one vote.

To constitute a quorum with respect to each matter to be presented at the annual meeting, there must be present, in person or by proxy, a majority of the total votes entitled to be cast by Record Holders of the common stock. Abstentions will be treated as present for purposes of determining a quorum. In addition, shares held by a broker as nominee (i.e., in “street name”) that are represented by proxies at the Annual Meeting, but that the broker fails to vote on one or more matters as a result of incomplete instructions from a beneficial owner of the shares (“broker non-votes”), will also be treated as present for quorum purposes. The election of directors is no longer considered a “routine” matter as to which brokers may vote in their discretion on behalf of clients who have not furnished voting instructions with respect to the election of directors. As a result, if you hold your shares in street name and do not provide your broker with voting instructions, your shareswill not be voted at the annual meeting with respect to the election of directors or the Company’s Say-on-Pay proposal or the proposal relating to the increase in the number of shares available under the 2008 Equity Incentive Plan.proposal. The ratification of BDO USA, LLP as our independent registered public accounting firm is considered a “routine matter,” and therefore, brokers will have the discretion to vote on this matter even if they do not receive voting instructions from the beneficial owner of the shares.

With respect to Proposal 1 regarding the election of directors, assuming a quorum, the candidates receiving a plurality of the votes cast by the Record Holders of the common stock will be elected directors. Under plurality voting, assuming a quorum is present, the candidates receiving the most votes will be elected, regardless of whether they receive a majority of the votes cast. Abstentions and broker non-votes will have no effect on the outcome.

With respect to Proposal 2 regarding approval of the independent registered public accounting firm, ratification of this appointment requires that a quorum be present and that the number of votes cast “for” the proposal exceeds the votes cast “against” it. Abstentions and broker non-votes will have no effect on the outcome.

2

With respect to Proposal 3 regarding approval of the Say-on-Pay Resolution, and Proposal 4 regarding an increase in the number of shares available under the 2008 Equity Incentive Plan, approval of each of these proposalsthis proposal requires that a quorum be present and that the number of votes cast “for” the proposal exceed the votes cast “against” it. Abstentions and broker non-votes will have no effect on the outcomes.outcome. The Company’s Say-on-Pay vote is advisory in nature, and the ultimate outcome of the vote is non-binding on the Company.

Votes cast by proxy or in person at the annual meeting will be counted by the person or persons appointed by the Company to act as inspector(s) of election for the meeting. Prior to the meeting, the inspector(s) will sign an oath to perform their duties in an impartial manner and to the best of their abilities. The inspector(s) will ascertain the number of shares outstanding and the voting power of each of such shares, determine the shares represented at the meeting and the validity of proxies and ballots, count all votes and ballots and perform certain other duties as required by law.

We expect that shares owned by current executive officers and directors of the Company will be voted in favor of the nominees for director that have been recommended by the Board and in accordance with the Board’s recommendations on the other proposals. As of April 21, 2014,15, 2015, shares owned by current executive officers and directors of the Company and entitled to vote at the annual meeting represented in the aggregate approximately 6.00%5.87% of the shares of common stock outstanding on that date.

Any other proposal not addressed herein but properly presented at the meeting will be approved if a proper quorum is present and the votes cast in favor of it meet the threshold specified by the Company’s Articles, Bylaws and by Georgia law with respect to the type of matter presented. No shareholders have submitted notice of intent to present any proposals at the annual meeting as required by the Company’s Bylaws.

Important Notice Regarding the Availability of Proxy Materials for the Shareholder Meeting to Be Held on June 24, 201416, 2015

In accordance with rules adopted by the United States Securities and Exchange Commission (the “SEC”), we are also making this proxy statement and our annual report available to shareholders electronically via the Internet. To access this proxy statement and the Company’s Annual Report on Form 10-K on the Internet, please visitwww.prgx.com/proxy.

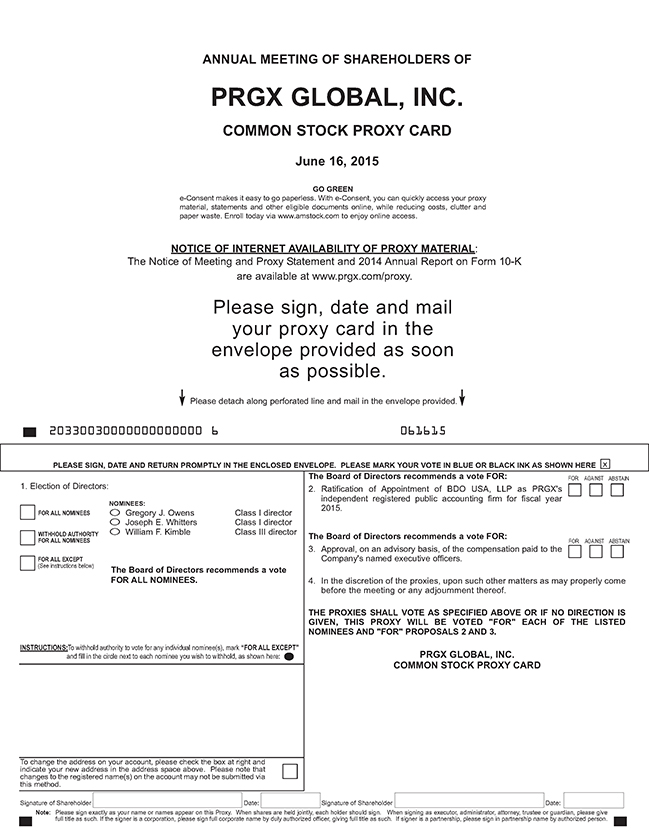

PROPOSAL 1: ELECTION OF DIRECTORS

The Company currently has eightnine directors. The Board is divided into three classes of directors, designated as Class I, Class II and Class III. The directors in each class serve staggered three-year terms. Shareholders annually elect directors to serve for the three-year term applicable to the class for which such directors are nominated or until their successors are elected and qualified. At the annual meeting, shareholders will be voting to elect (i) two directors to serve as Class IIII directors; and (ii) one director to serve as a Class IIII director. The terms of David A. Cole, Archelle Georgiou FeldshonGregory J. Owens and Philip J. Mazzilli, Jr.,Joseph E. Whitters, currently serving as Class I directors, and William F. Kimble, currently serving as a Class III directors,director, will expire at the annual meeting unless they are re-elected. While Mr. Mazzilli’sThe term is expiring as a Class III director, he has been nominated for electionof Philip J. Mazzilli, Jr., currently serving as a Class I director, in order to maintain the number of directors in each class as equal as possible. Mr. Mazzilli’s move from Class III to Class I is necessary due to the previously announced resignation of Class I director Steven P. Rosenberg immediately following the 2014 Annual Meeting of Shareholders. Mr. Rosenberg’s resignation would leave Class I with only one director in the absence of another Class I director being electedwill expire at the 2014 Annual Meeting of Shareholders.annual meeting. Mr. Rosenberg will continue to serveMazzilli is not standing for re-election as a director and as a memberresult of the Audit Committee andBoard’s director retirement policy, which provides that a director who has reached the Compensation Committee through the 2014 Annual Meetingage of Shareholders.72 will not be nominated for re-election.

3

The persons named in the proxy intend to vote FOR the election of all the nominees named below as directors of the Company, unless otherwise specified in the proxy. Those directors of the Company elected at the annual meeting to be held on June 24, 201416, 2015, to serve as Class IIII or Class IIII directors, as the case may be, will each serve a three- or one-yeartwo-year term, respectively, or until their successors are elected

3

and qualified. Each of the nominees has consented to serve on the Board of Directors if elected. Should any nominee become unable to accept nomination or election, which is not anticipated, it is the intention of the persons named in the proxy, unless otherwise specifically instructed in the proxy, to vote for the election of such other person as the Board of Directors may nominate.

Set forth below are the name, age and director class of each director nominee and director continuing in office following the annual meeting and the period during which each has served as a director.

The Board’s Nominees for Class IIII Directors are:

Nominee | Age | Service as Director | ||

| 55 | Since March 2015 | ||

Joseph E. Whitters(1)(2) | Since | |||

|

| (1) | Member of the |

| (2) | Member of the |

The Board’s Nominee for Class IIII Director is:

Nominee | Age | Service as Director | ||

| Since |

The Board of Directors of the Company recommends a vote FOR the election of each of the nominees named above for election as director.

Directors Continuing in Office

Continuing Director | Age | Class | Term Expires | Service as Director | ||||

Joseph E. Whitters(1)(2) | 56 | Class I | 2015 | Since January 2013 | ||||

Patrick G. Dills(1) | 60 | Class II | 2016 | Since March 2006 | ||||

Mylle H. Mangum(3) | 65 | Class II | 2016 | Since January 2013 | ||||

Ronald E. Stewart | 59 | Class II | 2016 | Since November 2012 |

Continuing Director | Age | Class | Term Expires | Service as Director | ||||

Patrick G. Dills(1) Mylle H. Mangum(2)(3) Ronald E. Stewart David A. Cole(2)(3) Archelle Georgiou Feldshon(3) | 61 66 60 72 52 | Class II Class II Class II Class III Class III | 2016 2016 2016 2017 2017 | Since March 2006 Since January 2013 Since November 2012 Since February 2003 Since September 2010 |

| (1) | Member of the Audit Committee. |

| (2) | Member of the Compensation Committee. |

| (3) | Member of the Nominating and Corporate Governance Committee. |

4

Information about Nominees for Election as a Class I Director

Gregory J. Owens is currently serving as the Chairman and Chief Executive Officer of IronPlanet, a leading online marketplace for used heavy equipment. Prior to serving in his current role at IronPlanet, Mr. Owens served as Managing Director of RedZone Capital, a private equity company focused on turning around and growing under-performing companies. Prior to RedZone Capital, Mr. Owens served as Chairman and Chief Executive Officer of Manugistics Group Inc., a publicly traded global enterprise software solutions company. Mr. Owens also previously served as Global Managing Partner Supply Chain Management of Andersen Consulting (now Accenture). Mr. Owens has received numerous awards from the business community including: Maryland Technology CEO of the Year, Washington Titan of Business and Mid-Atlantic Technology Entrepreneur of the Year.

4

Mr. Owens brings broad business experience to the Board as a result of his having held numerous executive level roles for several companies. Mr. Owens also brings to the Board many years of experience serving on boards of directors, including his previous service as a director of S1 Corporation, a publicly traded software company, and his current and past service on the board of directors of a number of private companies, primarily in the software industry.

Joseph E. Whitters has been a consultant to Frazier Healthcare, a private equity firm, since 2005. From 1986 to 2005, Mr. Whitters served in various capacities with First Health Group Corp., a publicly traded managed care company, including for a majority of that time as its Chief Financial Officer. He also previously served as the Controller for United Healthcare Corp. from 1984 to 1986. Prior to that, Mr. Whitters served as the Manager of Accounting and Taxation for Overland Express, a publicly traded trucking company, and he began his career in public accounting with Peat Marwick (now KPMG). Mr. Whitters currently serves as a director of InfuSystem Holdings, Inc., a provider of ambulatory infusion pumps and associated clinical services. The Board has determined that Mr. Whitters qualifies to serve as an Audit Committee financial expert.

Mr. Whitters is a CPA and brings to the Board over 30 years of financial and other business experience, much of it in the healthcare industry. He developed extensive financial expertise and leadership abilities during his service in senior finance roles at First Health Group and United Healthcare, which has allowed him to bring these critical abilities and accounting skills to the Board.

Information about Nominee for Election as a Class III Director

William F. Kimble served as KPMG’s Office Managing Partner of the Atlanta office and Managing Partner – Southeastern United States, where he was responsible for the firm’s audit, advisory and tax operations from 2009 until his retirement in early 2015. Mr. Kimble was also responsible for moderating KPMG’s Audit Committee Institute (ACI) and Audit Committee Chair Sessions. Mr. Kimble had been with KPMG or its predecessor firm (Peat, Marwick, Main & Co.) since 1986. During his tenure with KPMG, Mr. Kimble held numerous senior leadership positions, including Global Chairman for Industrial Markets. Mr. Kimble also served as KPMG’s Energy Sector Leader for approximately 10 years and was the executive director of KPMG’s Global Energy Institute.

Mr. Kimble brings many years of international business experience to the Board, having acquired knowledge of the needs and inner workings of global companies and having developed a multinational business perspective through his work at KPMG. Mr. Kimble also brings to the Board a broad knowledge of the most current and pressing audit issues faced by public companies today.

Information about the Class I Director whose Term will Expire at the 2015 Annual Meeting of Shareholders

Philip J. Mazzilli, Jr. is a financial and general business consultant. From 2000 to 2003 he was Executive Vice President and Chief Financial Officer of Equifax Corporation, an international provider of consumer credit information and information database management. From 1999 to 2000 he was Executive Vice President and Chief Financial Officer of Nova Corporation, a payment services company.

Mr. Mazzilli brings highly valuable financial expertise, leadership skills and strategic planning abilities to the Board, developed from his many years as a finance manager and executive, including his prior service as Chief Financial Officer at Equifax and Nova Corporation. He is highly experienced and knowledgeable in financial analysis, financial statements and risk management, and the Board has determined that he qualifies to serve as an Audit Committee financial expert.

5

Information about the Class II Directors whose Terms will Expire at the 2016 Annual Meeting of Shareholders

Patrick G. Dills is Chairman of PRGX Global, Inc. He also served as Interim President and Chief Executive Officer of the Company in 2008 to 2009. Mr. Dills also serves as Chairman of Ameritox Ltd., a laboratory in the medication monitoring market. Mr. Dills previously served as Executive Chairman of MSC Group, Inc. (now One Call Medical) from 2006 to 2012 and he served as the Chairman of Paradigm Management Services, LLC from 2009 to 2012. Mr. Dills also served from 1988 to 2005 in several executive positions at First Health Group Corp. (now part of Aetna). Mr. Dills’s last positions at First Health Group were President of CCN (Community Care Networks) and Executive Vice-President.

Mr. Dills has extensive experience serving in senior leadership and management roles of several companies. Through this service, his service as a member of the Compensation and Audit Committees of Paradigm Management Services, LLC, and his prior service as a director of a public company, Mr. Dills has developed excellent leadership and risk oversight skills and a solid understanding of corporate governance matters.

Mylle H. Mangum is the Chief Executive Officer of IBT Enterprises, LLC, a company focused on design, construction and training services for the financial services and specialty retail industries, a position that she has held since 2003. She was formerly the Chief Executive Officer of True Marketing Services, LLC. Prior to this, she served as the CEO of MMS Incentives, Inc. from 1999 to 2002. Ms. Mangum also previously served in management roles with Holiday Inn Worldwide, BellSouth and General Electric. Ms. Mangum currently serves as a director for Barnes Group Inc., Haverty Furniture Companies, Inc. and Express, Inc. and previously served as a director for Collective Brands, Inc., Emageon Inc., a provider of enterprise-level information technology to healthcare provider organizations, Matria Healthcare, Inc., a provider of health advisory services, and Respironics, Inc., a medical supply company.

Ms. Mangum brings to the Board particular knowledge and years of experience in retail, merchandising, marketing, strategy, technology, supply chain, logistics, international business, and multi-division general management experience. She also brings to the Board many years of experience serving on the boards of directors of publicly traded companies.

Ronald E. Stewartis the Company’s President and Chief Executive Officer. He was appointed interim President and interim Chief Executive Officer of the Company on November 15, 2013 and became the Company’s permanent President and Chief Executive Officer effective as of December 13, 2013. In addition to his roles with the Company, Mr. Stewart is an investor and business entrepreneur. Prior to his current pursuits, Mr. Stewart was a senior partner with Accenture, holding a number of executive positions during his 30-year career at the firm. Mr. Stewart retired from Accenture in October 2007. During his tenure at Accenture, Mr. Stewart served as the global client partner for a number of Fortune 100 clients and led the firm’s retail and consumer goods practice in the eastern United States for a number of years. Mr. Stewart also led Accenture’s global transportation and travel industry program and served as the North America Managing Partner for the automotive, industrial manufacturing and transportation/travel industry groups. Mr. Stewart is a former member of Accenture’s Global Executive Committee and of the board of directors of the Accenture Foundation.

6

Mr. Stewart brings to the Board management’s perspective of the Company and its operations, which is an invaluable asset to the Board in its direction of the Company’s future. Mr. Stewart also brings to the Board expertise in the fundamental analysis of investment opportunities and the evaluation of business strategies and valuable leadership skills and knowledge gained from over 30 years of providing global professional services to clients during his tenure at Accenture.

Information about the Class III Directors whose Terms will Expire at the 2017 Annual Meeting of Shareholders

David A. Cole is the retired Chairman of the Board and Chief Executive Officer of Kurt Salmon Associates, Inc. (“KSA”), an international management consulting firm serving the retail, consumer products and healthcare industries. He was appointed president of KSA in 1983, served as its chief executive officer from 1988 through 1998 and served as its chairman from 1988 to 2001. Mr. Cole formerly served as a director of AMB Property Corporation, a global owner and operator of industrial real estate, until its merger with Prologis, Inc. in 2011. Mr. Cole currently serves on the Dean’s Advisory Council of Goizueta Business School at Emory University.

Having served as Chairman and CEO of KSA, Mr. Cole brings deep experience in global professional services to the Board of Directors. Through his prior service on the board of directors of several publicly-traded companies, Mr. Cole has significant experience and expertise in the areas of corporate management, leadership, executive compensation and corporate governance.

Archelle Georgiou Feldshon, M.D.is the president of Georgiou Consulting, LLC, a healthcare consulting firm that she founded in December of 2007. Prior to December 2007, Dr. Georgiou worked for UnitedHealth Group Corporation for over 12 years in numerous executive-level positions, including National Medical Director, Chief Medical Officer, CEO – Care Management, and culminating with her position as Executive Vice President – Strategic Relations, Specialized Care Services. Over the course of her career, Dr. Georgiou has made numerous media contributions regarding the latest healthcare industry news and trends, including, since January 2007, as a healthcare expert and media correspondent for a twice weekly television segment in Minneapolis-St. Paul, Minnesota. Dr. Georgiou is an instructor at the University of Minnesota Carlson School of Business. She is also a Senior Advisor to TripleTree and Chair of Health Executive Roundtable, a healthcare think tank focusing on innovative changes in the healthcare industry. Dr. Georgiou graduated from the Johns Hopkins School of Medicine in 1986. She trained and practiced in internal medicine in Northern California before transitioning into healthcare administration and policy.

Dr. Georgiou brings to the Board many years of management, leadership and marketing and communications experience, including over two decades of experience in the healthcare industry and highly valuable expertise in the areas of healthcare management and policy, the use of healthcare databases in the development of healthcare informatics, predictive modeling and software development. Dr. Georgiou’s experience and perspective provide the Board with valuable insight, particularly with respect to the Company’s healthcare-related services.

Information about Nominee for Election as a Class I Director

Philip J. Mazzilli, Jr.is a financial and general business consultant. From 2000 to 2003 he was Executive Vice President and Chief Financial Officer of Equifax Corporation, an international provider of consumer credit information and information database management. From 1999 to 2000 he was Executive Vice President and Chief Financial Officer of Nova Corporation, a payment services company.

Mr. Mazzilli brings highly valuable financial expertise, leadership skills and strategic planning abilities to the Board, developed from his many years as a finance manager and executive, including his prior service as Chief Financial Officer at Equifax and Nova Corporation. He is highly experienced and knowledgeable in financial analysis, financial statements and risk management, and he qualifies to serve as an Audit Committee financial expert.

5

Information about the Class I Directors whose Terms will Expire at the 2015 Annual Meeting of Shareholders

Steven P. Rosenbergis President of SPR Ventures, Inc., a private investment company he founded in 1997, and President of SPR Packaging LLC. From 1992 to 1997 he was President of the Arrow subsidiary of ConAgra Foods, Inc., a packaged food company. Mr. Rosenberg also serves as a director of Texas Capital Bancshares, Inc., a bank holding company, and Cinemark Holdings, Inc., a motion picture exhibition company. As previously disclosed, Mr. Rosenberg has given notice to the Company of his intention to resign from the Board of Directors of the Company effective immediately following the 2014 Annual Meeting of Shareholders.

Mr. Rosenberg has over 30 years of experience in general corporate management, including oversight of corporate financial affairs. He also has years of experience serving on the boards of directors of publicly traded companies. Through general corporate management experience and his service on these public company boards, Mr. Rosenberg has extensive knowledge in the areas of leadership, risk management, financial oversight and corporate governance.

Joseph E. Whitters has been a consultant to Frazier Healthcare, a private equity firm, since 2005. From 1986 to 2005, Mr. Whitters served in various capacities with First Health Group Corp., a publicly traded managed care company, including for a majority of that time as its Chief Financial Officer. He also previously served as the Controller for United Healthcare Corp. from 1984 to 1986. Prior to that, Mr. Whitters served as the Manager of Accounting and Taxation for Overland Express, a publicly traded trucking company, and he began his career in public accounting with Peat Marwick (now KPMG). Mr. Whitters currently serves as a director of InfuSystem Holdings, Inc., a provider of ambulatory infusion pumps and associated clinical services.

Mr. Whitters is a CPA and brings to the Board over 30 years of financial and other business experience, much of it in the healthcare industry. He developed extensive financial expertise and leadership abilities during his service in senior finance roles at First Health Group and United Healthcare, which has allowed him to bring these critical abilities and accounting skills to the Board.

Information about the Class II Directors whose Terms will Expire at the 2016 Annual Meeting of Shareholders

Patrick G. Dills is Chairman of the Board of PRGX Global, Inc. He also served as Interim President and Chief Executive Officer of the Company in 2008 and 2009. Mr. Dills serves as Chairman of the Board of Ameritox Ltd., a laboratory and leader in pain medication monitoring. Mr. Dills formerly served as Chairman of the Board of Paradigm Management Services, LLC, a provider of complex and catastrophic medical management services which was sold in February 2012, and as a director of MSC Group, Inc., a leader in the delivery of medical products and services which was sold in August 2012. Mr. Dills served from 1988 to 2005 in several executive positions at First Health Group Corp. Mr. Dills’ last positions were President of CCN (Community Care Networks) and President of Health Net Plus.

Mr. Dills has extensive experience serving in senior leadership and management roles of several companies in the healthcare industry. Through this service, his service as a member of the Compensation and Audit Committees of Paradigm Management Services, LLC, and his prior service as a director of a public company, Mr. Dills has developed critical healthcare industry knowledge, excellent leadership and risk oversight skills and a solid understanding of corporate governance matters.

Mylle H. Mangum is the Chief Executive Officer of IBT Enterprises, LLC, a company focused on design, construction and training services for the financial services and specialty retail industries, a

6

position that she has held since 2003. She was formerly the Chief Executive Officer of True Marketing Services, LLC. Prior to this, she served as the CEO of MMS Incentives, Inc. from 1999 to 2002. Ms. Mangum also previously served in management roles with Holiday Inn Worldwide, BellSouth and General Electric. Ms. Mangum currently serves as a director for Barnes Group Inc., Haverty Furniture Companies, Inc. and Express, Inc. and previously served as a director for Collective Brands, Inc., Emageon Inc., a provider of enterprise-level information technology to healthcare provider organizations, Matria Healthcare, Inc., a provider of health advisory services, and Respironics, Inc., a medical supply company.

Ms. Mangum brings to the Board particular knowledge and years of experience in retail, merchandising, marketing, strategy, technology, supply chain, logistics, international business, and multi-division general management experience. She also brings to the Board many years of experience serving on the boards of directors of publicly traded companies.

Ronald E. Stewartis the Company’s President and Chief Executive Officer. He was appointed interim President and interim Chief Executive Officer of the Company on November 15, 2013 and became the Company’s permanent President and Chief Executive Officer effective as of December 13, 2013. In addition to his roles with the Company, Mr. Stewart is an investor and business entrepreneur. Prior to his current pursuits, Mr. Stewart was a senior partner with Accenture, holding a number of executive positions during his 30-year career at the firm. Mr. Stewart retired from Accenture in October 2007. During his tenure at Accenture, Mr. Stewart served as the global client partner for a number of Fortune 100 clients and led the firm’s retail and consumer goods practice in the eastern United States for a number of years. Mr. Stewart also led Accenture’s global transportation and travel industry program and served as the North America Managing Partner for the automotive, industrial manufacturing and transportation/travel industry groups. Mr. Stewart is a former member of Accenture’s Global Executive Committee and of the board of directors of the Accenture Foundation.

Mr. Stewart brings to the Board management’s perspective of the Company and its operations, which is an invaluable asset to the Board in its direction of the Company’s future. Mr. Stewart also brings to the Board expertise in the fundamental analysis of investment opportunities and the evaluation of business strategies and valuable leadership skills and knowledge gained from over 30 years of providing global professional services to clients during his tenure at Accenture.

7

PROPOSAL 2: RATIFY THE APPOINTMENT OF INDEPENDENT

REGISTERED PUBLIC ACCOUNTING FIRM

Our Board of Directors, upon the recommendation of our Audit Committee, has appointed BDO USA, LLP (“BDO”) as the Company’s independent registered public accounting firm for the 20142015 fiscal year. A proposal will be presented at the annual meeting to ratify the appointment of BDO as our independent registered public accounting firm for the 20142015 fiscal year. Shareholder ratification of the selection of BDO as our independent registered public accounting firm is not required but is being presented to our shareholders as a matter of good corporate practice. Notwithstanding shareholder ratification of the appointment of the independent registered public accounting firm, the Audit Committee, in its discretion, may direct the appointment of a new independent registered public accounting firm if the Audit Committee believes that such a change would be in our best interests and the best interests of our shareholders. If the shareholders do not ratify the appointment, the Audit Committee will reconsider the appointment of BDO. We have been advised that a representative from BDO will be present at the annual meeting, will be given an opportunity to speak if he or she desires to do so, and will be available to answer appropriate questions.

The Board of Directors recommends a vote FOR approval to ratify the appointment of the independent registered public accounting firm.

8

PROPOSAL 3: ADVISORY VOTE ON EXECUTIVE COMPENSATION

The Dodd-Frank Wall Street Reform and Consumer Protection Act (the “Dodd-Frank Act”) requires that the Company’s shareholders have the opportunity to cast a non-binding advisory vote regarding the compensation of the Company’s executive officers who are named in the Summary Compensation Table contained in this proxy statement whom we refer to as our “named executive officers.” We have disclosed the compensation of our named executive officers pursuant to rules adopted by the SEC.

At our annual meeting of shareholders held on May 24, 2011, our shareholders approved our proposal to hold a “Say-on-Pay” vote every year. As a result, we have committed to annual “Say-on-Pay” votes. At our annual meeting of shareholders held on June 18, 2013,24, 2014, our shareholders approved our “Say-on-Pay” resolution with approximately 66.5%91% of the votes cast approving the 20122013 executive compensation described in our 20132014 proxy statement. Although the Company obtained majority support for the executive compensation program from shareholders via the 2013 Say-on-Pay vote, the 66.5% level of support was lower than the Company and the Compensation Committee would like to see. Since the 2013 Say-on-Pay vote, we have had discussions with many of our large shareholders regarding our compensation program and practices. In determining executive compensation for 2014,2015, the committee has considered and will continue to consider the shareholder support that the “Say-on-Pay” proposal received at the 20132014 annual meeting of shareholders. While we would like to have a higher level ofThis strong support from our shareholders than was indicated by the results ofconfirms our 2013 Say-on-Pay vote, we believebelief that our compensation programs are reasonable, effectively designed and continue to be aligned with the interests of our shareholders.

As we describe in detail in the Compensation Discussion and Analysis section and the accompanying compensation tables and narrative discussion contained in this proxy statement, we have designed our executive compensation programs to drive our long-term success and increase shareholder value. We use our executive compensation programs to provide compensation that will (i) attract and retain our named executive officers, (ii) encourage our named executive officers to perform at their highest levels by directly linking a material portion of their total compensation with key Company financial and operational performance objectives, and (iii) directly align our executive compensation with shareholders’ interests through the grants of equity-based incentive awards.

Our Compensation Committee has overseen the development and implementation of our executive compensation programs using these core compensation principles as a guide. Our Compensation Committee also continuously reviews, evaluates and updates our executive compensation programs as needed to ensure that we continue to provide competitive compensation that motivates our named executive officers to perform at their highest levels while simultaneously increasing long-term shareholder value. We highlight the following aspects of our executive pay program that we believe reflect sound governance and effective program design:

9

9

This advisory shareholder vote, commonly referred to as a “Say-on-Pay” vote, gives you as a shareholder the opportunity to approve or not approve the compensation of our named executive officers that is disclosed in this proxy statement by voting for or against the following resolution (or by abstaining with respect to the resolution):

RESOLVED, that the compensation paid to the Company’s named executive officers, as disclosed in this proxy statement in accordance with the compensation disclosure requirements of the Securities and Exchange Commission, including the Compensation Discussion and Analysis, compensation tables and the related narrative disclosures herein, is hereby APPROVED.

Because your vote is advisory, it will not be binding on either the Board of Directors or the Company. However, our Compensation Committee will take into account the outcome of the shareholder vote on this proposal when considering future executive compensation decisions and arrangements.

The Board of Directors recommends a vote FOR approval of the compensation paid to the Company’s named executive officers as disclosed in this proxy statement in accordance with the compensation disclosure requirements of the Securities and Exchange Commission, including in Compensation Discussion and Analysis, compensation tables and the related narrative disclosures.

10

PROPOSAL 4: AMENDMENT OF THE 2008 EQUITY INCENTIVE PLAN

At the 2008 Annual Meeting, the shareholders of the Company approved the PRGX Global, Inc. 2008 Equity Incentive Plan (as amended, the “Incentive Plan”), to assist the Company in recruiting and retaining individuals with ability and initiative by enabling them to receive awards and thereby participate in the future success of the Company. At the 2014 Annual Meeting, the Company’s shareholders will be asked to approve an amendment to the Incentive Plan that will increase the available shares reserved for awards under the Incentive Plan by 3,000,000 shares (the “Amendment”). As it relates to these 3,000,000 shares, the Amendment will provide that any shares issued in connection with an award will count against the available pool on a one-to-one basis. Previously authorized shares issued in connection with awards, other than options and SARs, will continue to be counted against the available pool as 1.41 shares. The Board of Directors unanimously approved the Amendment on April 25, 2014 and recommends that the Company’s shareholders approve and adopt the Amendment. The Amendment is effective as of April 25, 2014, contingent on approval of the Company’s shareholders within 12 months after such date.

Reasons for and Purpose of the Amendment

Equity Awards Foster an Employee Ownership Culture and Motivate Employees to Create Shareholder Value.

The use of equity as part of our compensation program is critical to the future success of the Company. Equity awards foster an ownership culture among key employees by aligning their financial interests with those of our shareholders. Our equity awards are intended to motivate key employees to perform at peak levels because the value of these awards is linked to the long-term performance of the Company.

Equity Awards are a Critical Recruitment and Retention Tool for Our Key Employees.

We operate in an intensely competitive environment and recruiting and retaining talented employees is critical to our success. A competitive compensation program for our key employees is therefore essential to our long-term performance. We believe that equity awards are necessary to attract and retain highly talented employees. We believe we would be at a severe competitive disadvantage if we could not compensate our key employees using equity awards. If our shareholders do not approve the Amendment, we would have to drastically limit the amount of equity awards, which, to remain competitive, means we would likely need to increase the cash component of our compensation programs for key employees. This could negatively impact the retention of our key employees, as they would have less equity at risk of forfeiture when considering offers from other employers, including our competitors. At the same time, our recruiting efforts would be compromised due to the loss of or severe limitations on our ability to use equity as a form of compensation to attract key employees.

We Grant Annual Equity Awards to Our Key Employees and Such Annual Awards Constitute a Significant Component of Our Key Employees’ Total Compensation.

Annual equity awards are a significant component of our key employees’ total compensation. As a key employee’s total compensation increases, the percentage of his or her compensation paid in equity generally increases. In June 2013, approximately 56 employees received equity awards as part of our annual equity grant. Of these awards, 40.4% were granted to our named executive officers, 13.6% to other executive officers and non-employee directors, and the remaining 46.0% to our top talent below the executive officer level.

11

The Board believes that the Amendment would assist us in retaining our directors, officers, and key employees, and motivating them to exert their best efforts on behalf of the Company. We also believe it would ensure that we are able to attract future key employees vital to implementing our business strategy. In addition, we expect that the Amendment would further align the interests of the directors, officers, and key employees with those of our shareholders.

We Have Limited Shares Available for Equity Awards to Our Key Employees Under the Incentive Plan

As of March 31, 2014, options to purchase 2,123,202 shares of the Company’s common stock, 675,141 restricted shares, and 148,641 restricted stock units were outstanding under the Incentive Plan and only 981,366 shares of the Company’s common stock remain available for equity awards under the Incentive Plan. These remaining shares are expected to be exhausted as part of our 2014 annual equity grant, which is scheduled to occur on or around the date of the 2014 Annual Meeting. Following the planned 2014 annual equity grant, unless the Amendment to the Incentive Plan is approved, it is expected that there will be no shares remaining available for grant under the Incentive Plan.

Shareholder Protections Provided by the Incentive Plan

The Incentive Plan includes numerous provisions that are designed to protect our shareholders’ interests and to reflect corporate best practices, including:

Summary of the Incentive Plan

The Incentive Plan is intended to permit the grant of stock options (both incentive stock options (“ISOs”) and non-qualified stock options (“NQSOs”)), stock appreciation rights (“SARs”), restricted stock (“Restricted Stock Awards”), restricted stock units (“RSUs”) and other incentive awards (“Incentive Awards”). A summary of the principal features of the Incentive Plan follows. Every aspect of the Incentive Plan is not addressed in this summary. Shareholders are encouraged to read the full text of the Incentive Plan and the Amendment, copies of which are filed asAppendix A to this Proxy Statement.

All awards granted under the Incentive Plan are governed by separate written agreements between the Company and the relevant participant. The written agreements specify when the award may

12

become vested, exercisable or payable. No right or interest of a participant in any award is subject to any lien, obligation or liability of the participant. The laws of the State of Georgia govern the Incentive Plan. The Incentive Plan is unfunded, and the Company will not segregate any assets for grants of awards under the Incentive Plan. No awards may be granted after March 24, 2018, the date which is 10 years after the original adoption of the Incentive Plan by the Board.

It is intended that awards granted under the Incentive Plan shall be exempt from treatment as “deferred compensation” subject to Section 409A of the Internal Revenue Code of 1986 (and any amendments thereto) (the “Code”). The Incentive Plan is not subject to the Employee Retirement Income Security Act of 1974, as amended (“ERISA”), and it is not intended to be, and is not, qualified under Section 401(a) of the Code.

Administration.The Company bears all expenses of administering the Incentive Plan. Our Compensation Committee (the “Committee”) of the Board of Directors administers the Incentive Plan. The Committee has the authority to grant awards to such persons and upon such terms and conditions (not inconsistent with the provisions of the Incentive Plan), as it may consider appropriate. The Committee may delegate to one or more officers of the Company all or part of its authority and duties with respect to awards to individuals who are not subject to Section 16 of the Securities Exchange Act of 1934.

Eligibility for Participation.Any of the Company’s employees or service providers, including any employees or service providers of our Affiliates (as defined in the Incentive Plan), and any non-employee member of our Board of Directors or the boards of directors of our Affiliates, is eligible to receive an award under the Incentive Plan. However, ISOs may only be granted to employees of the Company or an Affiliate.

Shares Subject to Plan.The maximum number of shares of Common Stock that may be issued under the life of the Incentive Plan pursuant to awards will be 10,600,000 shares, assuming the shareholders approve the Amendment (which is an increase of 3,000,000 shares over those previously reserved under the Incentive Plan). Shares underlying awards will only be counted against the available pool of shares to the extent they are actually used. Shares issued in connection with an award will count against the available pool on a one-to-one basis except that shares issued in connection with awards, other than options and SARs, that are granted on or after April 27, 2010 and are part of the pool of 7,600,000 shares available for issuance prior to April 25, 2014 will count against the available pool as 1.41 shares, and shares covered under a stock–settled SAR shall count against the available pool even though not actually issued. If any awards expire or are cancelled, terminated or forfeited for any reason other than their exercise, vesting or payment, or are settled in cash, the shares of Common Stock subject to such awards will again be available for issuance. The following shares, however, will not be available again for awards: shares not issued as the result of a net settlement of an award; shares used to pay the exercise price or withholding taxes with respect to an award; and shares repurchased on the open market with the proceeds of the exercise price of an award.

In any calendar year, no participant may be granted options, SARs, Restricted Stock Awards, RSUs, or any combination thereof that relate to more than 500,000 shares. In any calendar year, no participant may be granted an Incentive Award (i) with reference to a specified dollar limit for more than $1.5 million and (ii) with reference to a specified number of shares of Common Stock for more than 500,000 shares. The maximum number of shares of Common Stock that may be issued pursuant to awards, the per individual limits on awards and the terms of outstanding awards will be adjusted as the Committee in its sole discretion determines is equitably required in the event of corporate transactions and other appropriate events.

13

Options.A stock option entitles the participant to purchase from the Company a stated number of shares of Common Stock. The Committee will determine whether the option is intended to be an ISO or a NQSO and specify the number of shares of Common Stock subject to the option. In the case of ISOs, the aggregate fair market value (determined as of the date of grant) of Common Stock with respect to which an ISO may become exercisable for the first time during any calendar year cannot exceed $100,000; and if this limitation is exceeded, the ISOs which cause the limitation to be exceeded will be treated as NQSOs. The exercise price per share of Common Stock may not be less than the fair market value of the Common Stock on the date the option is granted. With respect to an ISO granted to a participant who beneficially owns more than 10% of the combined voting power of the Company or any Affiliate (determined by applying certain attribution rules), the exercise price per share may not be less than 110% of the fair market value of the Common Stock on the date the option is granted. The exercise price may be paid in cash or, if the agreement so provides, the Committee may allow a participant to pay all or part of the exercise price by tendering shares of Common Stock the participant already owns, through a broker-assisted cashless exercise, by means of “net exercise” procedure, or any other specified medium of payment.

Stock Appreciation Rights (“SARs”).A SAR entitles the participant to receive, upon exercise, the excess of the fair market value on that date of each share of Common Stock subject to the exercised portion of the SAR over the fair market value of each such share on the date of the grant of the SAR. A SAR can be granted alone or in tandem with an option. A SAR granted in tandem with an option is called a Corresponding SAR and entitles the participant to exercise the option or the SAR at which time the other tandem award expires. The Committee will specify the number of shares of Common Stock subject to a SAR and whether the SAR is a Corresponding SAR. No participant may be granted Corresponding SARs in tandem with ISOs which are first exercisable in any calendar year for shares of Common Stock having an aggregate fair market value (determined as of the date of grant) that exceeds $100,000; and if this limitation is exceeded the tandem option will be treated as NQSOs. A Corresponding SAR may be exercised only to the extent that the related option is exercisable and the fair market value of the Common Stock on the date of exercise exceeds the exercise price of the related option. As set forth in the agreement, the amount payable as a result of the exercise of a SAR may be settled in cash, shares of Common Stock or a combination of each.

Restricted Stock Awards.A Restricted Stock Award is the grant or sale of shares of Common Stock, which may be subject to forfeiture restrictions. The Committee will prescribe whether the Restricted Stock Award is forfeitable and the conditions to which it is subject. If the participant must pay for a Restricted Stock Award, payment for the award generally shall be made in cash or, if the agreement so provides, by surrendering shares of Common Stock the participant already owns or any other medium of payment. Prior to vesting or forfeiture, a participant will have all rights of a shareholder with respect to the shares underlying the Restricted Stock Award, including the right to receive dividends and vote the underlying shares; provided, however, the participant may not transfer the shares. The Company may retain custody of the certificates evidencing the shares until they are no longer forfeitable.

RSUs.An RSU entitles the participant to receive shares of Common Stock when certain conditions are met. The Committee will prescribe when the RSUs shall become payable. The Company will pay the participant one share of Common Stock for each RSU that becomes earned and payable.

Incentive Awards.An Incentive Award entitles the participant to receive cash or Common Stock or a combination of each when certain conditions are met. The Committee will prescribe the terms and conditions of the Incentive Award. As set forth in the participant’s agreement, an Incentive Award may be paid in cash, shares of Common Stock or a combination of each.

14

Performance Objectives.The Committee has discretion to establish objectively-determinable performance conditions for when awards will become vested, exercisable and payable. Objectively-determinable performance conditions are performance conditions (i) that are established in writing (a) at the time of grant (b) no later than the earlier of (x) 90 days after the beginning of the period of service to which they relate and (y) before the lapse of 25% of the period of service to which they relate; (ii) that are uncertain of achievement at the time they are established; and (iii) the achievement of which is determinable by a third party with knowledge of the relevant facts. These performance conditions may include any or any combination of the following: (a) gross, operating or net earnings before or after taxes; (b) return on equity; (c) return on capital; (d) return on sales; (e) return on investments; (f) return on assets or net assets; (g) earnings per share; (h) cash flow per share; (i) book value per share; (j) gross margin; (k) customers; (l) cash flow or cash flow from operations; (m) fair market value of the Company or any Affiliate or shares of Common Stock; (n) share price or total shareholder return; (o) market share; (p) level of expenses or other costs; (q) gross, operating or net revenue; (r) earnings before interest and taxes; (s) adjusted earnings before interest and taxes; (t) profitability; (u) earnings before interest, taxes, depreciation and amortization; (v) adjusted earnings before interest, taxes, depreciation and amortization; (w) adjusted earnings before interest, taxes, depreciation and amortization less capital expenditures; or (x) peer group comparisons of any of the aforementioned performance conditions. Performance conditions may be related to a specific customer or group of customers or geographic region. The form of the performance conditions also may be measured on a Company, Affiliate, division, business unit, service line, segment or geographic basis or a combination thereof. Performance goals may reflect absolute entity performance or a relative comparison of entity performance to the performance of a peer group of entities or other external measure of the selected performance conditions. Profits, earnings and revenues used for any performance condition measurement may exclude any extraordinary or nonrecurring items. The performance conditions may, but need not, be based upon an increase or positive result under the aforementioned performance criteria and could include, for example and not by way of limitation, maintaining the status quo or limiting the economic losses (measured, in each case, by reference to the specific business criteria). An award that is intended to become exercisable, vested or payable on the achievement of performance conditions means that the award will not become exercisable, vested or payable solely on mere continued employment or service. However, such an award, in addition to performance conditions, may be subject to continued employment or service by the participant. Additionally, the vesting, exercise or payment of an award can be conditioned on mere continued employment or service if it is not intended to qualify as qualified performance-based compensation under Section 162(m) of the Code.

Change in Control.In the event of or in anticipation of a “Change in Control” (as defined in the Incentive Plan), the Committee in its discretion may terminate outstanding awards (i) by giving the participants an opportunity to exercise the awards that are then exercisable and then terminating, without any payment, all awards that have not been exercised (including those that were not then exercisable) or (ii) by paying the participant the value of the awards that are then vested, exercisable or payable without payment for any awards that are not then vested, exercisable or payable or that have no value. Alternatively, the Committee may take such other action as the Committee determines to be reasonable under the circumstances to permit the participant to realize the vested value of the award. The Committee may provide that a participant’s outstanding awards become fully exercisable or payable on and after a Change in Control or immediately before the date the awards will be terminated in connection with a Change in Control. Awards will not be terminated to the extent they are to be continued after the Change in Control.

Shareholder Rights.No participant shall have any rights as a shareholder of the Company until the award is settled by the issuance of Common Stock (other than a Restricted Stock Award or RSUs for which certain shareholder rights may be granted).

15

Transferability.Generally, an award is non-transferable except by will or the laws of descent and distribution, and during the lifetime of the participant to whom the award is granted, the award may only be exercised by, or payable to, the participant. However, the Committee may provide that awards, other than ISOs or a Corresponding SAR that is related to an ISO, may be transferred by a participant to any of such class of transferees who can be included in the class of transferees who may rely on a Form S-8 Registration Statement under the Securities Act of 1933 to sell shares issuable upon exercise or payment of such awards. Any such transfer will be permitted only if (i) the participant does not receive any consideration for the transfer, (ii) the Committee expressly approves the transfer and (iii) the transfer is on such terms and conditions as are appropriate for the class of transferees who may rely on the Form S-8 Registration Statement. The holder of the transferred award will be bound by the same terms and conditions that governed the award during the period that it was held by the participant, except that such transferee may only transfer the award by will or the laws of descent and distribution.

Maximum Award Period.No award shall be exercisable or become vested or payable more than ten years after the date of grant. An ISO granted to a participant who beneficially owns more than 10% of the combined voting power of the Company or any Affiliate (determined by applying certain attribution rules) or a Corresponding SAR that relates to such an ISO may not be exercisable more than five years after the date of grant.

Compliance With Applicable Law.No award shall be exercisable, vested or payable except in compliance with all applicable federal and state laws and regulations (including, without limitation, tax and securities laws), any listing agreement with any stock exchange to which the Company is a party, and the rules of all domestic stock exchanges on which the Company’s shares may be listed.

Amendment and Termination of Plan.The Board of Directors may amend or terminate the Incentive Plan at any time; provided, however, that no amendment may adversely impair the rights of a participant with respect to outstanding awards without the participant’s consent. An amendment will be contingent on approval of the Company’s shareholders, to the extent required by law, by the rules of any stock exchange on which the Company’s securities are then traded or if the amendment would (i) increase the benefits accruing to participants under the Incentive Plan, including without limitation, any amendment to the Incentive Plan or any agreement to permit a repricing or decrease in the exercise price of any outstanding options or SARs, (ii) increase the aggregate number of shares of Common Stock that may be issued under the Incentive Plan, (iii) modify the requirements as to eligibility for participation in the Incentive Plan or (iv) change the stated performance conditions for qualified performance-based compensation under Section 162(m) of the Code. Additionally, to the extent the Board deems necessary for the Incentive Plan to continue to grant awards that are intended to comply with the performance-based exception to the deduction limits of Code Section 162(m), the Board will submit the material terms of the stated performance conditions to the Company’s shareholders for approval no later than the first shareholder meeting that occurs in the fifth year following the year in which the shareholders previously approved the material terms of the performance goals.

Notwithstanding any other provision of the Incentive Plan, the Committee may amend any outstanding award without participant’s consent if, as determined by the Committee in its sole discretion, such amendment is required either to (i) confirm exemption from Section 409A of the Code, (ii) comply with Section 409A of the Code or (iii) prevent the Participant from being subject to any tax or penalty under Section 409A of the Code.

Forfeiture Provisions.Awards do not confer upon any individual any right to continue in the employ or service of the Company or any Affiliate. All rights to any award that a participant has will be immediately forfeited if the participant is discharged from employment or service for “Cause” (as defined in the Incentive Plan).

16

Federal Income Tax Consequences

The following discussion summarizes the principal United States federal income tax consequences associated with awards granted under the Incentive Plan to U.S. citizens. The discussion is based on laws, regulations, rulings and court decisions currently in effect, all of which are subject to change.

ISOs.A participant will not recognize taxable income on the grant or exercise of an ISO. A participant will recognize taxable income when he or she disposes of the shares of Common Stock acquired under the ISO. If the disposition occurs more than two years after the grant of the ISO and more than one year after its exercise (the “ISO holding period”), the participant will recognize long-term capital gain (or loss) to the extent the amount realized from the disposition exceeds (or is less than) the participant’s tax basis in the shares of Common Stock. A participant’s tax basis in shares of the Common Stock generally will be the amount the participant paid for the shares.

If Common Stock acquired under an ISO is disposed of before the expiration of the ISO holding period described above, the participant will recognize as ordinary income in the year of the disposition the excess of the fair market value of the Common Stock on the date of exercise of the ISO over the exercise price. Any additional gain will be treated as long-term or short-term capital gain, depending on the length of time the participant held the shares. A special rule applies to such a disposition where the amount realized is less than the fair market value of the Common Stock on the date of exercise of the ISO. In that case, the ordinary income the participant will recognize will not exceed the excess of the amount realized on the disposition over the exercise price. If the amount realized is less than the exercise price, the participant will recognize a capital loss (long-term if the stock was held more than one year and short-term if held one year or less). A participant will receive different tax treatment if the exercise price is paid by delivery of Common Stock the participant already owns.

Neither the Company nor any of its Affiliates will be entitled to a federal income tax deduction with respect to the grant or exercise of an ISO. However, in the event a participant disposes of Common Stock acquired under an ISO before the expiration of the ISO holding period described above, the Company or its Affiliate will be entitled to a federal income tax deduction equal to the amount of ordinary income the participant recognizes.

NQSOs.A participant will not recognize any taxable income on the grant of a NQSO. On the exercise of a NQSO, the participant will recognize as ordinary income the excess of the fair market value of the Common Stock acquired over the exercise price. A participant’s tax basis in the Common Stock is the amount paid plus any amounts included in income on exercise. The participant’s holding period for the stock begins on acquisition of the shares. Any gain or loss that a participant realizes on a subsequent disposition of Common Stock acquired on the exercise of a NQSO generally will be treated as long-term or short-term capital gain or loss, depending on the length of time the participant held such shares. The amount of the gain (or loss) will equal the amount by which the amount realized on the subsequent disposition exceeds (or is less than) the participant’s tax basis in his or her shares. A participant will receive different tax treatment if the exercise price is paid by delivery of Company Stock the participant already owns.

The exercise of a NQSO will entitle the Company or its Affiliate to claim a federal income tax deduction equal to the amount of ordinary income the participant recognizes. If the participant is an employee, that ordinary income will constitute wages subject to withholding and employment taxes.

SARs.A participant will not recognize any taxable income at the time the SARs are granted. The participant at the time of receipt will recognize as ordinary income the amount of cash and the fair market

17

value of the Common Stock that he or she receives. The Company or its Affiliate will be entitled to a federal income tax deduction equal to the amount of ordinary income the participant recognizes. If the participant is an employee, that ordinary income will constitute wages subject to withholding and employment taxes.

Restricted Stock Awards.A participant will recognize ordinary income on account of a Restricted Stock Award on the first day that the shares are either transferable or not subject to a substantial risk of forfeiture. The ordinary income recognized will equal the excess of the fair market value of the Common Stock on such date over the amount, if any, the participant paid for the Restricted Stock Award. However, even if the shares under a Restricted Stock Award are both nontransferable and subject to a substantial risk of forfeiture, the participant may make a special “83(b) election” to recognize income, and have his or her tax consequences determined, as of the date the Restricted Stock Award is made. The participant’s tax basis in the shares received will equal the income recognized plus the price, if any, paid for the Restricted Stock Award. Any gain (or loss) that a participant realizes upon the sale of any Common Stock acquired pursuant to a Restricted Stock Award will be equal to the amount by which the amount realized on the disposition exceeds (or is less than) the participant’s tax basis in the shares and will be treated as long-term (if the shares are held for more than one year) or short-term (if the shares are held for one year or less) capital gain or loss. The participant’s holding period for the stock begins on the date the shares are either transferable or not subject to a substantial risk of forfeiture, except that the holding period will begin on the date of grant if the participant makes the special “83(b) election.” The Company or its Affiliate will be entitled to a federal income tax deduction equal to the ordinary income the participant recognizes. If the participant is an employee, that ordinary income will constitute wages subject to withholding and employment taxes.

RSUs.The participant will not recognize any taxable income at the time the RSUs are granted. When the terms and conditions to which the RSUs are subject have been satisfied and the RSUs are paid, the participant, at the time of receipt, will recognize as ordinary income the fair market value of the Common Stock he or she receives. The participant’s holding period in the Common Stock will begin on the date the stock is received. The participant’s tax basis in the Common Stock will equal the amount he or she includes in ordinary income. Any gain or loss that a participant realizes on a subsequent disposition of the shares will be treated as long-term or short-term capital gain or loss, depending on the participant’s holding period for the stock (long-term if the shares are held for more than one year; short-term if one year or less). The amount of the gain (or loss) will equal the amount by which the amount realized on the disposition exceeds (or is less than) the participant’s tax basis in the Common Stock. The Company or its Affiliate will be entitled to a federal income tax deduction equal to the ordinary income the participant recognizes. If the participant is an employee, that ordinary income will constitute wages subject to withholding and employment taxes.

Incentive Awards.A participant will not recognize any taxable income at the time an Incentive Award is granted. When the terms and conditions to which an Incentive Award is subject have been satisfied and the award is paid, the participant, at the time of receipt, will recognize as ordinary income the amount of cash and the fair market value of the Common Stock he or she receives. The participant’s holding period in any Common Stock received will begin on the date of receipt. The participant’s tax basis in the Common Stock will equal the amount he or she includes in ordinary income with respect to such shares. Any gain or loss that a participant realizes on a subsequent disposition of the Common Stock will be treated as long-term or short-term capital gain or loss, depending on the participant’s holding period for the Common Stock (long-term if the shares are held for more than one year; short-term if one year or less). The amount of the gain (or loss) will equal the amount by which the amount realized on the disposition exceeds (or is less than) the participant’s tax basis in the Common Stock. The Company or its Affiliate will be entitled to a federal income tax deduction equal to the amount of ordinary income the participant recognizes. If the participant is an employee, that ordinary income will constitute wages subject to withholding and employment taxes.

18

Limitation on Deductions.The deduction for a publicly-held corporation for otherwise deductible compensation to a “covered employee” generally is limited to $1 million per year. An individual is a covered employee if he or she is the chief executive officer or one of the other three highest compensated officers for the year (other than the chief executive officer or chief financial officer). The $1 million limit does not apply to compensation payable solely because of the attainment of performance conditions that meet the requirements set forth in Section 162(m) of the Code and the regulations thereunder. Compensation is considered performance-based only if (a) it is paid solely on the achievement of one or more performance conditions; (b) two or more “outside directors” set the performance conditions; (c) before payment, the material terms under which the compensation is to be paid, including the performance conditions, are disclosed to, and approved by, the shareholders and (d) before payment, two or more “outside directors” certify in writing that the performance conditions have been met. The Incentive Plan has been designed to enable the Committee to structure awards that are intended to meet the requirements for qualified performance-based compensation that would not be subject to the $1 million per year deduction limit under Section 162(m) of the Code.

Any grant, exercise, vesting or payment of an award may be postponed if the Company reasonably believes that its or any applicable Affiliate’s deduction with respect to such award would be limited or eliminated by application of Code Section 162(m) to the extent permitted by Section 409A of the Code; provided, however, such delay will last only until the earliest date at which the Company reasonably anticipates the deduction will not be limited or eliminated under Code Section 162(m).

Other Tax Rules.The Incentive Plan is designed to enable the Committee to structure awards that are intended to not be subject to Code Section 409A, which imposes certain restrictions and requirements on deferred compensation.

Equity Plan Compensation Information

The following tables present certain information with respect to compensation plans under which equity securities of the registrant were authorized for issuance as of December 31, 2013 and March 31, 2014, respectively:

Plan category | Number of securities to be issued upon exercise of outstanding options, warrants and rights | Weighted-average exercise price of outstanding options, warrants and rights | Number of securities remaining available for future issuance under equity compensation plans (excluding securities reflected in column (a)) | |||||||||

| (a) | (b) | (c) | ||||||||||

Equity compensation plans approved by security holders: | ||||||||||||

Stock Incentive Plan | 255,955 | $ | 13.32 | — | ||||||||

2008 Equity Incentive Plan | 2,445,946 | 6.06 | 924,062 | |||||||||

Share awards(1) | 26,446 | — | 9,914 | |||||||||

Equity compensation plans not approved by security holders(2) | 333,519 | 4.45 | — | |||||||||

|

|

|

|

|

| |||||||

Total as of December 31, 2013 | 3,061,866 | $ | 6.49 | 933,976 | ||||||||

|

|

|

|

|

| |||||||

19

Plan category | Number of securities to be issued upon exercise of outstanding options, warrants and rights | Weighted-average exercise price of outstanding options, warrants and rights | Number of securities remaining available for future issuance under equity compensation plans (excluding securities reflected in column (a)) | |||||||||

| (a) | (b) | (c) | ||||||||||

Equity compensation plans approved by security holders: | ||||||||||||

Stock Incentive Plan | 250,955 | $ | 13.31 | — | ||||||||

2008 Equity Incentive Plan | 2,101,118 | 6.31 | 981,366 | |||||||||

Share awards(1) | 26,446 | — | 9,914 | |||||||||

Equity compensation plans not approved by security holders(2) | 65,000 | 8.11 | — | |||||||||

|

|

|

|

|

| |||||||

Total as of March 31, 2014 | 2,443,519 | $ | 7.01 | 991,280 | ||||||||

|

|

|

|

|

| |||||||

The Board of Directors recommends a vote FOR approval of the Amendment to the Incentive Plan.

20

INFORMATION ABOUT THE BOARD OF DIRECTORS